2025

Comparably’s Best Company Outlook

* Providing engineering services in these locations through SWCA Environmental Consulting & Engineering, Inc., an affiliate of SWCA.

From the experts we hire, to the clients we partner with, our greatest opportunity for success lies in our ability to bring the best team together for every project.

That’s why:

At SWCA, sustainability means balancing humanity’s social, economic, and environmental needs to provide a healthy planet for future generations.

SWCA employs smart, talented, problem-solvers dedicated to our purpose of preserving natural and cultural resources for tomorrow while enabling projects that benefit people today.

At SWCA, you’re not just an employee. You’re an owner. Everyone you work with has a stake in your success, so your hard work pays off – for the clients, for the company, and for your retirement goals.

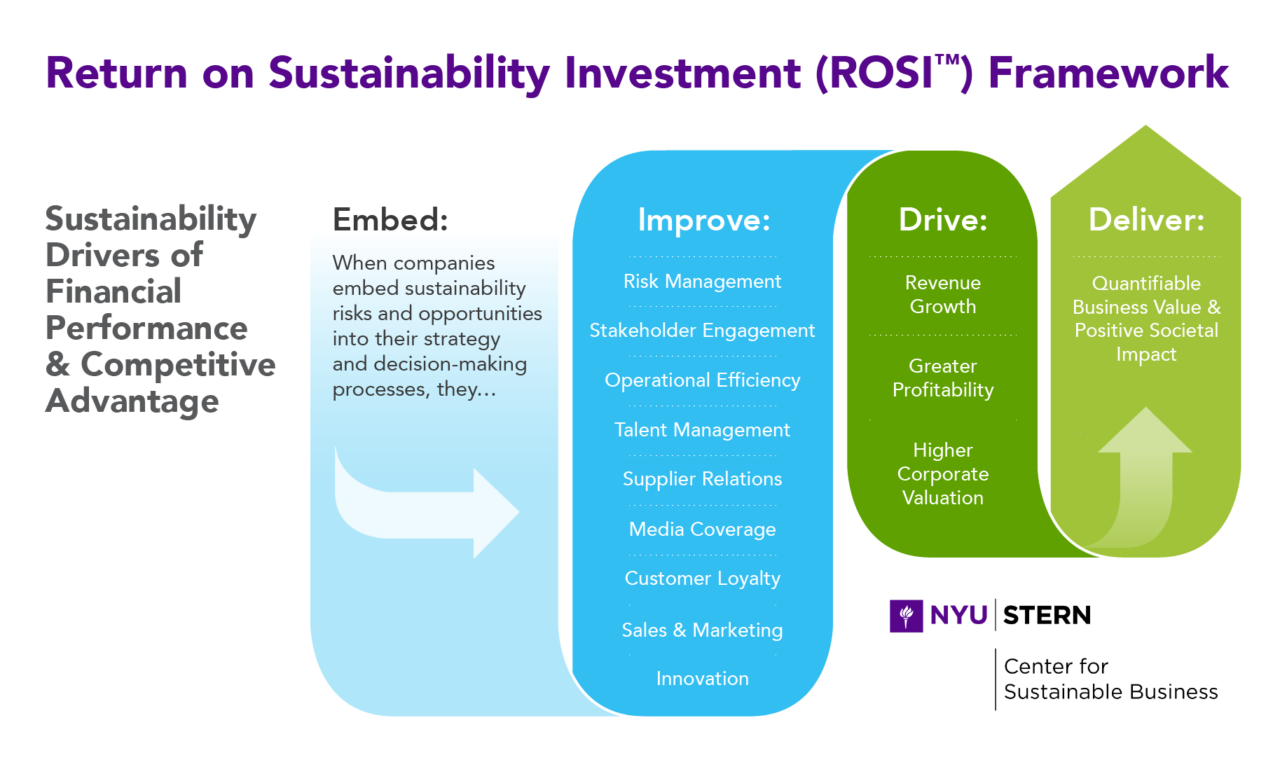

Sustainability Pays Off: Return on Sustainability Investment (ROSI) Methodology Makes the Business Case

For companies, investing in sustainability isn’t only about doing what’s right for the planet and people; it’s also about doing what’s right for their business and the bottom line.

John has more than 35 years of business, sustainability, environmental, health and safety leadership experience. His client engagements involve the development and implementation of strategies, plans, and programs that emphasize simultaneous creation of business, environmental, and social value for private sector clients, nongovernmental organizations (NGOs), and multilateral organizations operating domestically and internationally.

John has led projects in more than 40 countries in North America, Latin America, Europe, and APAC. He has been a thought leader and problem solver on topics such as business sustainability/resilience, water security/water stewardship, climate change, circularity/waste management, environmental and social impact measurement/monitoring and operational environmental, health, and safety (EHS) risk and performance management in developed and emerging economies. Additionally, John co-developed the Return on Sustainability Investment (ROSI) model with the New York University (NYU) Stern Center for Sustainable Business, which through business case and monetization tools enable better, more sustainable investment/resource allocation decisions.

Prior to consulting, John served on the corporate environmental staff for Scott Paper Company and Bristol-Myers Squibb and was a facility-level environmental engineer and safety director for a multi-site manufacturing operation. His current clients include Global 1000 organizations in the food and beverage, consumer products, energy, and business-to-business sectors.

Siena joined SWCA in 2021, helping bring the company’s voice to life through thoughtful, creative content as a Marketing Content Developer. She collaborates with teams across the world to turn big ideas into clear, engaging stories for social media, the web, and beyond. Whether she’s writing a headline or planning a campaign, she keeps environmental insight and integrity at the center of every piece—one carefully-crafted pun at a time.

Companies today often find themselves in a quandary when it comes to sustainable initiatives. While sustainability leaders focus on enhancing environmental and social performance by decreasing emissions, conserving resources, minimizing waste, and partnering with responsible vendors, financial leaders have additional concerns.

How do sustainability initiatives impact the bottom line and drive top-line growth? Will the initiative boost reputation and market share by connecting with clients or consumers? How certain are these benefits, and will the financial returns be significant?

“In order for organizations and entire industries to address the sustainability challenges that are accelerating in terms of risk — as well as opportunity — they need to be able to scale their sustainability efforts much more quickly,” said Tensie Whelan, the director of the New York University (NYU) Stern Center for Sustainable Business. “Scaling up requires understanding the business case to make larger investments, but it’s difficult for companies to calculate the financial returns, particularly when it comes to more intangible benefits like recruitment and retention of talent.”

The NYU Stern Center for Sustainable Business, in part in collaboration with ALO Advisors, developed the open-source Return on Sustainability Investment (ROSI™) methodology to bridge the gap between sustainability strategies and financial performance.

With ALO Advisors now a part of SWCA Environmental Consultants, we had the opportunity to sit down with sustainability and management consulting experts John Platko, Miriam Cavazos, and Kathia Elizondo, along with Whelan.

In our conversation, we learned about the ROSI methodology and how the team has applied it in various industries and discovered how these opportunities to build business cases for innovative initiatives allowed clients to advance their goals in decarbonization, circularity, climate change resilience, and more.

Sustainability investments have grown in the last decade, partially because of pressures from investors for companies to improve their performance and disclosures on environmental, social, and governance (ESG) criteria, and partially because organizations have recognized a host of additional benefits.

When a company invests in sustainability strategies and practices, it can positively impact a range of areas, including customer loyalty, employee retention and productivity, innovation, media coverage, operational efficiency, risk management, sales and marketing, supplier relations, and stakeholder engagement. To identify, quantify, and monetize these particular benefits, enter the ROSI methodology.

When companies embed sustainability, this influences a suite of mediating factors that drive financial benefits for businesses and society, which can be quantified and monetized. Image source: NYU Stern Center for Sustainable Business.

To monetize these areas, also referred to as mediating factors, a systematic process is required. ROSI helps bring a common language and measurement scale to the potential benefits and costs associated when pursuing sustainability strategies and practices. Centered around the mediating factors that have been shown to drive profits, increase corporate valuation, and reduce costs, the ROSI framework enables companies to assess the financial returns on their sustainability projects and initiatives.

Organizations can apply ROSI to look retrospectively at the value created by sustainability strategies, to track sustainability-related financial performance, and to assess the potential return on investment of future sustainability initiatives.

“ROSI is a flexible, fit-for-purpose tool that can be applied to any organization, sector, or particular sustainability effort,” explains Cavazos, project sustainability analyst at SWCA. “We help companies analyze, for example, how water scarcity will impact their business in the future. We work with the energy sector to help companies understand if switching energy sources is a viable case. ROSI can even be used to evaluate the consequences of inaction, helping businesses understand how much it will cost them if they don’t invest now – and then, identify the best time to invest.”

“Quantifying and monetizing the tangible and intangible benefits is the fun part. It’s complex, but that’s where our passion and expertise align,” says Elizondo, strategy management team lead at SWCA. “Based on a variety of data sources, we develop the formulas and calculations specific to the organization’s sustainability desires to run two analyses – one that models if they continue their work business as usual and one that accounts for implementing a particular sustainability strategy. It’s the difference between those two that demonstrate the financial return on investment or the costs of inaction.”

When Canada announced its decision to phase out coal-fired electricity by 2030, a North American power producer’s coal fleet suddenly became a significant risk. Recognizing the consequences of inaction, the company partnered with ALO Advisors and NYU Stern Center for Sustainable Business to apply the ROSI framework to assess whether it should phase out coal sooner than required.

“Because it’s based on financial and practical analyses, ROSI is a key tool to support decision making and deciding if a sustainable investment makes economic sense,” says Platko, vice president of sustainability and management consulting at SWCA. “When the economics work, the environmental and social benefits that we try to create last. When the economics don’t work, the benefits don’t last.”

As the initial step in this process, the company conducted a materiality assessment. Key internal and external stakeholders were engaged to identify the most impactful ESG issues for the company. Climate change emerged as the most substantial risk. It became clear that the company needed to formulate a business plan to transform into a more sustainable energy provider.

Leaders from various corporate functions participated in a comprehensive two-day workshop aimed at defining an action plan to address ESG issues, with a strong emphasis on climate change. The group concluded that a pivotal step toward becoming a more sustainable business would involve accelerating the reduction in the use of coal as a fuel source and establishing competitive greenhouse gas emission reduction targets.

Subsequently, the team analyzed which of the mediating factors could reflect the benefits and value of a quicker transition away from coal. Key factors included lower cost of debt, lower cost of equity, and improved employee productivity and retention. Several studies have shown that companies with good sustainability practices are perceived as less risky, and therefore have lower costs to take on debt. Sustainable companies also have lower expected rates of return from investors, and therefore lower costs of equity. Studies have also shown that employees are more engaged, and therefore more productive and less likely to leave when they feel their employer values sustainability.

“Through the ROSI methodology, we can provide all the data and insights to make visions into reality, which is the backbone of creating and implementing sustainability strategies that are supported by economics and research,” explains Elizondo.

Working closely with the power producer’s corporate finance team, the consulting team established equations to estimate the value increases resulting from each of these mediating factors. As a result, it became evident that all four benefits had a positive effect on the company’s bottom line. Consequently, the company made a public commitment to accelerate its transition to natural gas at one of its generating stations that had previously relied on coal. The company expects to save approximately $31 million over ten years by switching to natural gas at the generating station. By considering the potential financial gains stemming from sustainability initiatives, the company was able to make an informed and profitable decision.

“You have better tools to determine where you should be making and scaling up investment,” says Whelan, underscoring the significance of using ROSI to reach this decision.

See a detailed case study in “Using the Return on Sustainability Investment (ROSI) Framework to Value Accelerated Decarbonization.”

In 2022, ALO Advisors analyzed the added advantages of adopting green hydrogen as a step to reduce reliance on natural gas for a consumer goods manufacturer’s facility in the United Kingdom.

The project didn’t initially advance as the cost of implementing green hydrogen was found to surpass that of natural gas, owing to its experimental nature as well as the associated production expenses.

“In this case, the initial cost analysis showing green hydrogen to be more expensive than natural gas is not surprising. Implementing green hydrogen strategies is still in the early stages, and initial investments can be higher,” explains Cavazos. “However, with ROSI, we consider the long-term benefits, including intangible opportunities and enhanced resilience in a changing market.”

Upon reevaluation through the ROSI methodology, it became evident that the project entailed intangible benefits in addition to the enhancement of energy efficiency that far outweighed its costs. The analysis revealed fewer greenhouse gas taxes, forecasted sales growth, and the ability to secure a federal grant in the United Kingdom, in support of the company’s commitment to exploring innovative energy sources.

With the project moving ahead, this global consumer products company now anticipates the elimination of more than 25,000 metric tons of greenhouse gases annually, representing an approximate 35% reduction in Scope 1 emissions across all its operations in the United Kingdom. They are also receiving public recognition for their leadership as the first among competitors to pursue decarbonization of thermal energy sources by planning this switch from natural gas to hydrogen made with renewable power.

This strategic move also enables the company to incorporate a further testament to its sustainability efforts into its product portfolio, which could attract new sales and revenue. Research from the NYU Stern Center for Sustainable Business found that products made sustainably experience double the growth rate compared to their conventional counterparts, commanding an average premium of 28%.

By using the insights derived from the ROSI analysis, the manufacturer shared its project plans and articulated the anticipated impact on the company’s 2030 sustainability goals.

Learn more about Sustainability and Management Consulting at SWCA and Return on Sustainability Investment at NYU Stern Center for Sustainable Business.

John Platko has more than 30 years of business, sustainability, and environmental, health, and safety leadership experience. He develops and executes strategies that prioritize the creation of business, environmental, and social value for a diverse range of clients, including private sector companies, non-government organizations, and multilateral organizations on a global scale. Platko’s experience spans across 40 countries, encompassing sustainability, innovation, digital technology, and collective action initiatives addressing water security, climate resilience, and waste management.

Miriam Cavazos is an economist specializing in data analysis and its application to enhance decision-making and operational improvement. She applies her expertise in various areas, including water security, climate, water replenishment, risk management, environmental governance, and circularity.

Kathia Elizondo is a sustainable development engineer with experience in water efficiency in operations, water security, circular economy, collective action, and monetization. With a background in both the private and public sectors, Elizondo focuses on integrating sustainability comprehensively into projects by conducting thorough assessments aligned with regulations and standards.

Tensie Whelan is a Clinical Professor of Business and Society at NYU and serves as the Director of the NYU Stern Center for Sustainable Business. Whelan also serves as a member of ALO Advisors’ Advisory Board. She has an extensive 25-year background in sustainability, engaging businesses spanning various industries in proactive sustainability initiatives. Whelan is widely recognized for her influence on business ethics.