2025

Comparably’s Best Company Outlook

* Providing engineering services in these locations through SWCA Environmental Consulting & Engineering, Inc., an affiliate of SWCA.

From the experts we hire, to the clients we partner with, our greatest opportunity for success lies in our ability to bring the best team together for every project.

That’s why:

At SWCA, sustainability means balancing humanity’s social, economic, and environmental needs to provide a healthy planet for future generations.

SWCA employs smart, talented, problem-solvers dedicated to our purpose of preserving natural and cultural resources for tomorrow while enabling projects that benefit people today.

At SWCA, you’re not just an employee. You’re an owner. Everyone you work with has a stake in your success, so your hard work pays off – for the clients, for the company, and for your retirement goals.

New California Climate Regulations and Their Impact on SWCA Clients

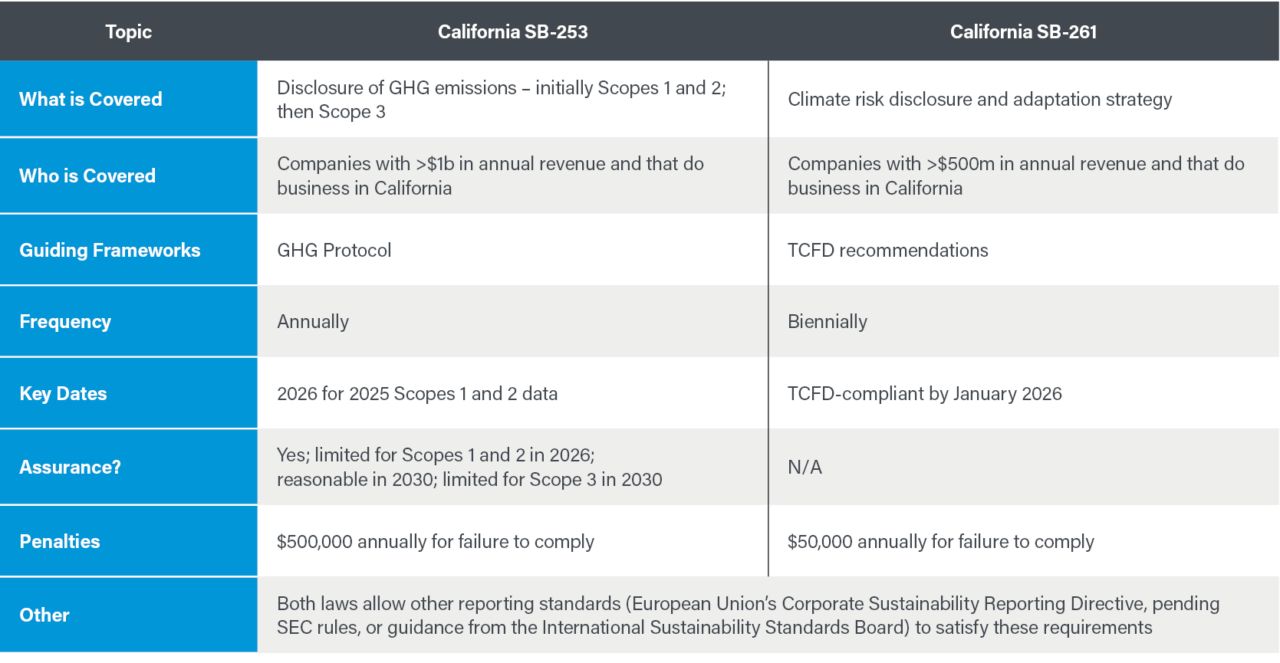

Recently enacted laws in California will require many companies to measure, manage, and disclose their greenhouse gas (GHG) emissions as well as their climate-related financial risks. [1]

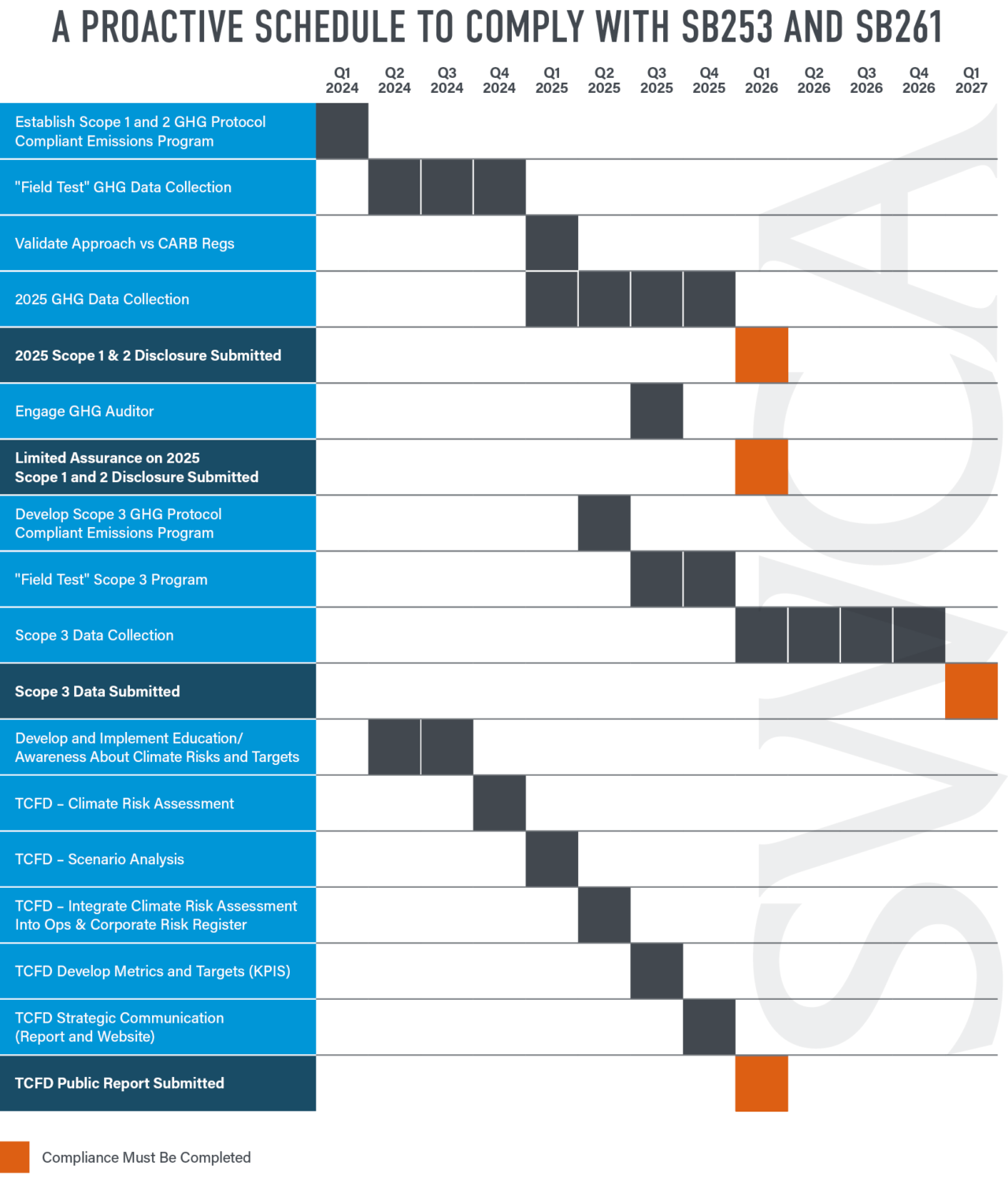

This summary provides a brief overview of the new California laws and suggests proactive steps companies should consider taking now to understand their current baseline and options for complying with these new laws.

In October 2023, Governor Newsom signed two new laws.

The Climate Corporate Data Accountability Act, SB-253 [2]

The Climate-Related Financial Risk Act, SB-261

Regulations, the ”how-to” process for complying, for SB-253 and SB-261 have not been issued at this time, and are not likely to be finalized until January 2025. Based on SWCA’s preliminary analysis, the California laws would apply to companies that meet the defined revenue levels, have in-state facilities and employees, or have existing sales in the state. [6]

If your company meets these threshold standards, SWCA recommends:

This suggested approach will also help companies meet the disclosure requirements currently in place for European based companies and investors (the Corporate Sustainability Reporting Directive, or CSRD), the anticipated U.S. Securities and Exchange Commission (SEC) climate rules, and the voluntary standards which are becoming increasingly required (IFRS S1 and S2).

SWCA’s Sustainability and Management Consulting team is available to assist you through this process and to identify ways in which these disclosure requirements can create value and minimize risk for your company.

[1] According to California Senate Floor Analysis, 5,344 companies would be required to disclose their GHG emissions under SB-253 and more than 10,000 companies meet the revenue requirements for SB-261.

[2] SB-253 Climate Corporate Data Accountability Act. Available here at CA.gov.

[3] Scope 1 covers direct emissions from owned or controlled sources, such as fuel combustion, company vehicles, or fugitive emissions. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company.

[4] Scope 3 includes all other indirect emissions that occur in a company’s value chain. Scope 3 emissions are divided into fifteen categories: purchased goods and services; capital goods; fuel-and energy-related activities; upstream transportation and distribution; waste generated in operations; business travel; employee commuting; upstream leased assets; downstream transportation and distribution; processing of sold products; end-of-life treatment of sold products; downstream leased assets; franchises; and investments.

[5] “Limited assurance” and “reasonable assurance” are two levels of assurance that an auditor can provide in a report. Limited assurance means that the auditor is not aware of any material issues or misstatements in the information reported. Reasonable assurance means that the auditor affirms that the information reported is materially correct and fairly presented. (Information from the U.S. Securities and Exchange Commission’s 2022 statement “Shelter from the Storm: Helping Investors Navigate Climate Change Risk.” Available here at SEC.gov.)

[6] Current California law defines “doing business” in California as engaging in any transaction for the purpose of financial gain within California, being organized or commercially domiciled in California, or having California sales, property, or payroll exceed specified amounts; as of 2020, these amounts are $610,395, $61,040, and $61,040, respectively (Revenue and Tax Code § 23101).